New Info For Choosing Forex Systems

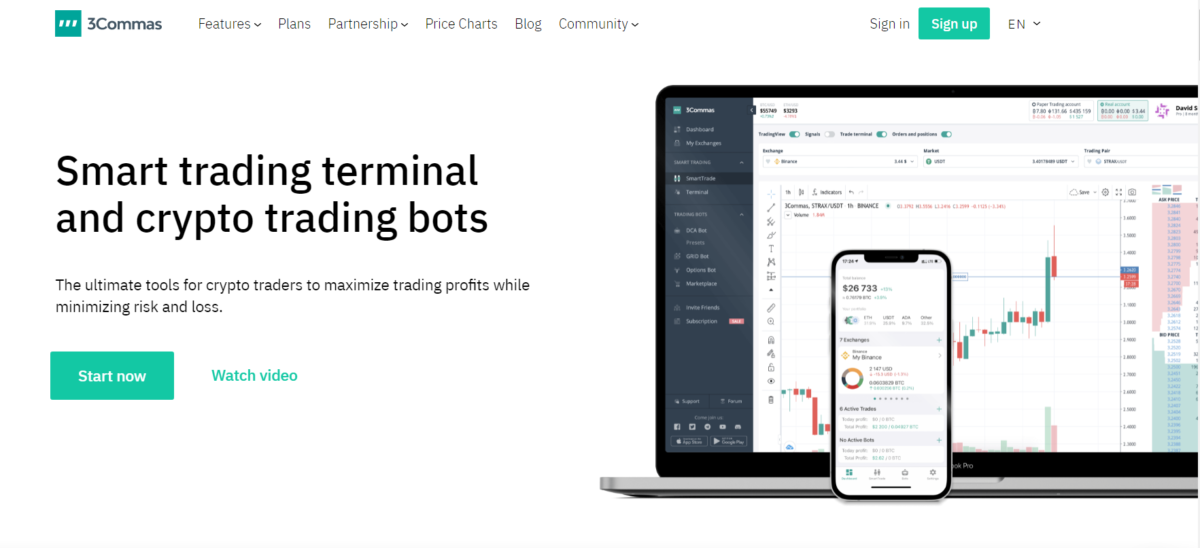

What Are Automated Trading Systems?Automated trading systems, also known as algorithmic trading or black-box trading are programs on computers that use mathematical algorithms to design trades in accordance with specific conditions. Automated trading platforms are developed to automate the execution of trades without human intervention.

Trading rules- Automated trading systems are programmed with specific trading rules and conditions that decide the time to start and end trades.

Data input - Automated trading Systems process huge amounts of market data real-time, and use this data for trading decisions.

Execution - Automated trading platforms can automate trades at an unimaginable speed for humans.

Risk management - Automated trading systems are able to be programmed to apply risk management strategies, including stop-loss orders as well as position sizing, to control the possibility of losses.

Backtesting: Before being employed for live trading, the automated trading software can be tested back.

The primary benefit of trading automation is that they can perform trades swiftly and precisely, without the need for human intervention. Automated trading systems are able to handle large quantities of data in a short time and make trades in accordance with certain rules and conditions. This helps reduce the impact of emotions and increase consistency in trading results.

Automated trading systems come with risks, such as system failures, errors in trading rules and the lack of transparency. It is essential to test and validate an automated trading platform before it is implemented in live trading. View the best stop loss order for blog recommendations including backtesting platform, automated trading systems, automated trading, backtesting trading, backtester, indicators for day trading, automated cryptocurrency trading, software for automated trading, free trading bot, best indicators for crypto trading and more.

How Does An Automated Trading Platform Function?

Automated trading systems process huge volumes of market data in real time and make trades in accordance with specific rules and regulations. These steps can be broken down into the following steps Determining the strategies for trading- This is the first step to establish the strategy for trading. This could include technical indicators like moving averages, or other conditions like price action , or even the emergence of new events.

Backtesting: After the trading strategy has been established, the next step in testing it on historical data from the market is to run it through a backtest to see how it performs and to identify any problems. This process lets traders evaluate the performance of the strategy over time, and make any needed adjustments prior to using it in live trading.

Coding - After the trading strategy was backtested and confirmed The next step in the procedure is to code the strategy into an automatic trading system. This is the process of converting the rules and conditions of the strategy to a programming language such as Python or MQL (MetaTrader License).

Data input- Automated trading systems require market data that is current to help make trading decisions. This data is typically obtained via a feed supplied by a vendor of market data.

Execution of trades - Once all the market data has been processed and all the conditions for a trading contract met, the automated system will then execute a trade. This includes sending the instructions for the trade to the brokerage, which will then put the trade on the market.

Monitoring and reporting Reporting and monitoring: Trading systems that are automated usually include built-in monitoring or report tools that let traders keep track and analyze the performance of the system and to spot any problems. This could include real-time performance reports as well as alerts for any unusual activity in the market, and trade logs.

Automated trading is possible in milliseconds. This speed is far more efficient than the time it takes a human trader to process data and execute trades. These speeds and accuracy could result in more consistent and efficient trading outcomes. However, it is important to test thoroughly and verify an automated trading system before using it in live trading to make sure that it's functioning correctly and meets the desired goals for trading. Check out the recommended which platform is best for crypto trading for more info including algo trading strategies, divergence trading forex, backtest forex software, how to backtest a trading strategy, best free crypto trading bot, psychology of trading, forex tester, best trading bot, cryptocurrency automated trading, backtesting strategies and more.

What Happened In The Flash Crash 2010

The 2010 Flash Crash was a sudden and intense stock market crash that happened on May 6, 2010. The flash crash, which took place on the 6th of May in 2010, was described as a severe and sudden market crash. The factors that contributed to the crash include:

HFT (high-frequency trades)HFT (high-frequency trading) HFT algorithms rely on sophisticated mathematical models as well as market data to generate trades. These algorithms are responsible for the high volume of trading which led to market instability as well as increased pressure on sellers in the flash crash.

Order cancellations - HFT algorithms were created to cancel orders if the market was moving in a direction that was not favorable, which caused additional selling pressure during the flash crash.

Liquidity- The crash was also caused by a lack of liquidity. Market makers and other market participants walked away in the midst of the crisis.

Market structure- The complex and fractured structure of the U.S. stock market, with various exchanges and dark pools made it challenging for regulators to monitor and react to the market crisis in real-time.

The flash crash caused serious effects on the markets for financial instruments. It caused significant losses for individual investors as well as market participants. Additionally, there was an increase in confidence among investors and a decrease in the stability of the stock market. The flash crash led regulators to take a number of measures to stabilize the market. These actions included circuit breakers which temporarily put a stop to trading in specific stocks during periods of extreme volatility and enhanced transparency. See the best backtesting software forex for website examples including trading algorithms, algo trading strategies, backtesting trading, backtesting strategies, backtesting tradingview, stop loss meaning, forex backtesting software free, best crypto trading platform, best crypto trading bot, free crypto trading bot and more.